Cash flow Diagrams and Interest rates

-

What is cash flow?

The net amount of cash and cash equivalents being transferred in and out of a company is called cash flow.

-

What is cash flow diagram?

- Cash flow diagrams are graphical representation of cash flows (inflows and out flows) along a time line.

- Individual inflows or outflows are designated by vertical lines and relative magnitude can be represented by the heights of lines.

- Cash inflows are designated by vertical lines above the axis and cash outflows below the time line axis.

- Inflows take a positive sign whereas outflows take negative sign.

- Cash flow diagrams involve magnitude and direction fulfilling the properties of flow.

There are five types of cash flow transaction:-

- single cash flow

- Uniform cash flow

- Linear gradient series

- Geometrical gradient series

- irregular series

Let’s discuss each of the above cash flow transactions.

Single payment cash flow: It involves a single present or future cash flow. The diagram of this is given below.

In this diagram there is single cash out flow (P) which occurs at ‘0’ time and Cash inflow of (F), which occurs at nth time.

Uniform cash flow: Here cash flows involve a series of equal amounts occurring at equal interval of time. It is also known as annuity.

Linear Gradient series: It is a series of cash flows displaying properties of arithmetic progression series. So the cash flow increases or decreases by a fixed amount.

Geometric Gradient series: It is a series of cash flows displaying properties of geometric progression series. So the cash flow increases or decreases by a fixed ratio (or percentage).

Irregular payment series: When the cash flows do not display any regular overall pattern over time, the series is known as Irregular payment series.

TIME VALUE OF MONEY

The time value of money (TVM) is the concept that a sum of money is worth more now than the same sum will be at a future date due to its earnings potential in the interim.

Example:-

A person has received a prize from a finance company during the recent festival season. But the prize will be given in either of the following two modes.

- Spot payment of $ 24.72

- $100 after 10 years from now( this is based on 15% interest rate compounded anually)

If the prize winner has no better choice that can yield more than 15% interest rate compounded anually, then it makes no difference whether he receives $24.72 or $100 after 10 years.

This conclusion is derived by calculating value of mony across different timelines using “TIME VALUE OF MONEY”.

INTEREST RATES

- Interest rate is the rental value of money. It represent the growth of capital per unit period. Because of interest rate and time factor, the numerical value of money (not purchasing power) multiplies over a period of time.

- Interest is the cost of using capital as well as the reward of parting with one’s liquidity (saved money).

INTEREST FORMULAS

While making investment decisions, computation will be done in many ways. To simplify all these computations, it is extremely important to know how to use interest formulas more ellectively.

1. Single Payment Compound Amount

The objective is to find the single future sum (F) of the initial payment (P) made at time 0 after n periods at an interest rate i compounded every period.

The formula to obtain the single payment compound amount is

$$ ⁍ $$

(F/P,i,n) is called as single payment compound amount factor.

Example:-

A person deposits a sum of 20,000 inr at the interest rate of 10% compounded anually for 10 years. Find the maturity value after 10 years.

solution

P = 20,000

i = 10% compounded anually

n = 10 years

using above formula

f = p(1+i)^n = 20,000 x 2.594 = 51,880 inr.

2. Single payment present worth amount

The objective is to find the present worth amount (p) of a single future sum (f) which will be received after n periods at an interest rate of i compounded at the end of every interest period.

The formula to obtain the present worth is

$$ p = f/(1+i)^n $$

(P/F,i,n) is termed as single payment present worth factor.

Example:-

A person wishes to have a future sum of $1,00,000 for his son’s education after 10 years from now. what is the single payment that he should deposit now so that he gets the desired amount after 10 years? The bank gives 15% interest rate compounded anually.

solution

f = 1,00,000

i = 15% compounded anually

n = 10 years

p = f/(1+i)^n = 1,00,000 x 0.2472 = 24,720$

The person has to invest $24,720 now so that he will get a sum of $1,00,000 after 10 years at 15%interest rate compounded anually.

3. Equal Payment series compound amount

The objective is to find the future worth of n equal payments which are made at the end of every interest period till the end of the nth interest period at an interest rate of i compounded at the end of each interest period.

The formula to obtain the F is

$$ F = A* (((1+i)^n -1)/i) $$

(F/A,i,n) is termed as equal payment series compound amount factor.

example

A person who is now 35 years old is planning for his retired life he plans to invest and equal sum of 10000 Rupees at the end of every year for the next 25 years starting from the end of next year the bank gives 10% interest rate compound anually. Find the maturity value of his account when he is 60 years old.

solution

A = 10,000

n = 25 years

i = 10%

by using formula given above

F = 10,000 x 98.347 = 9,83,470 inr

The future Sum of the annual equal payment after 25 years is equal to 9,83,470 rupees.

4. Equal Payment series sinking Fund

The objective is to find the equivalent amount (A) that should be deposited at the end of every interest period for n interest periods to realize a future sum (F) at the end of the nth interest period at an interest rate of i.

The formula to get F is

$$ A = F* (i/((1+i)^N-1)) $$

(A/F,i,n) is called equal payment series sinking fund factor.

Example

A company has to replace a present facility after 15 years at an outlay of 5,00,000 rupees. It plans to deposit an equal amount at the end of every year for the next 15 years at an interest rate of 9% compounded annually. Find the equivalent amount that must be deposited at the end of every year for the next 15 years.

solution

f = 5,00,000

n = 15 years

i = 9%

A = f*(i/((1+i)^n-1))

= 5,00,000 * 0.0341 = 17,050 rupees

The annual amount which must be deposited for 15 years is 17,050 rupees.

5. Equal payment series present worth Amount

The objective of this mode of investment is to find the present worth of an equal payment made at the end of every interest period for n interest periods at an interest rate of i compounded at the end of every interest period.

The formula to comute P is

$$ P = A*((1+i)^n-1)/i(1+i)^n $$

(P/A,i,n) is called equal payment series present worth factor.

Example

A company wants to set up a reserve which will help the company to have an annual equivalent amount of 10,00,000 rupees for the next 20 years towards its employees welfare measures. The reserve is assumed to grow at the rate of 15% annually. Find the single-payment that must e made now as the reserve amount.

Solution

A = 10,00,000

i = 15%

n = 20 years

by using above formula

p = 10,00,000 * 6.2593 = 62,59,300

The amount which must be set-up now is equal to 62,59,300 rupees.

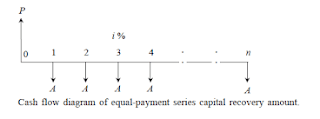

6. Equal payment series capital recovery amount

The objective of this mode of investment is to find the annual equivalent amount (A) which is to be recovered at the end of every interest period for n interest period for a loan (P) which is sanctioned now at an interest rate of i compounded at the end of every interest period.

The formula to compute P is

$$ A = P*(i(1+i)^N)/((1+i)^N-1) $$

(A/P,i,n) is called equal payment series capital recovery factor.

Example

A bank gives a loan to a company to purchase an equipment worth 10,00,000 rupees at an interest rate of 12% compounded annually. This amount should be repaid in 15 yearly equal installments. Find the installment amount that the company has to pay to the bank.

Solution

P = 10,00,000

i = 12%

n = 15 Years

by using above formula

A = 10,00,000 * 0.1468 = 1,46,800 rupees

the annual equivalent installment to be paid by the company to the bank is 1,46,800 rupees.

7. Uniform Gradient series annual Equivalent amount

The objective of this mode of investment is to find the annual equivalent amount of a series with an amount A1 at the end of the first year and with an equal increment (G) at the end of each of the following n-1 years with an interest rate i compounded annually.

The formula to compute A is

$$ A = A1+G*((1+i)^n-i*n-1)/(i(1+i)^n-i) $$

(A/G,i,n) is called uniform gradient series factor.

Example

A person is planning for his retired life. He has 10 more years of service. He would like to deposit 20% of his salary, which is 4,000 rupees, at the end of the first year and thereafter he wishes to deposit the amount with an annual increase of 500 rupees for the next 9 years with an interest rate of 15%. Find the total amount at the end of the 10th year of the above series.

solution

A1 = 4,000

G = 500

i = 15%

n =10 years

By using above formula

A = 4000 + 500(A/G,15%,10)

= 4000 + 500 X 3.3832 = 5691.60 rupees

This is equivalent to paying an equivalent amount of 5,691.60 rupees at the end of every year for the next 10 years.

The future sum is F = A(F/A,i,n)

= 5691.60(20.304) = 1,15,562.25

At the end of the 10th year, the compound amount of all his payments will be 1,15,562.25 rupees.

Comments

Post a Comment